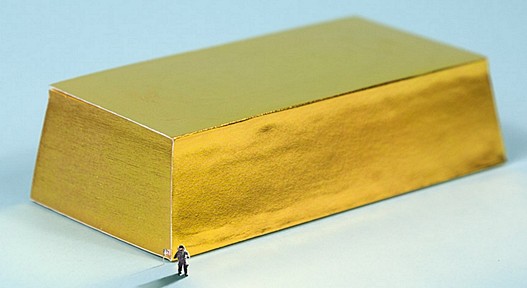

Back during the Great Depression the Roosevelt administration outlawed the private possession of gold. Based on the following report, it looks like Germany is headed in the same direction. It makes me wonder if global financiers are expecting a sudden increase in the price of gold — real, deliverable physical gold, that is, as opposed to a piece of paper or digital record that says you “own” gold.

I assume that the same sort of thing will soon be starting here in the USA, given the unprecedented amount of fiat money that is being injected into financial institutions. The price of gold should have skyrocketed several years ago. Maybe the Powers That Be have determined that they won’t be able to keep the price of gold artificially low for much longer.

Many thanks to Hellequin GB for translating this article from Altersvorsorge Neu Gedacht:

Selling gold and silver in Germany is made even more difficult

Since August, anyone who wants to sell two ounces of gold has to be able to document the origin of the gold at the bank. Anyone who no longer has an invoice for the gold purchase will be rejected.

Since August, the Federal Financial Supervisory Authority (BaFin) has asked banks to provide proof of origin for amounts of more than 10,000 euros for cash deposits. So if you want to pay a correspondingly large amount of cash into your account, you have to provide proof of the origin of the money. This also applies if the customer pays in several partial amounts under EUR 10,000, but the total amount exceeds EUR 10,000. If this proof is missing when making the payment, the bank customer must submit the proof immediately.

According to BaFin, suitable evidence consists of payment receipts for cash payments from other banks or savings banks, savings books in the name of the customer in which the cash payment can be seen, receipts for cash transactions, e.g. for a car sale, payment receipts for currency transactions (exchange with foreign means of payment), evidence of inheritance such as a certificate of inheritance, will or testamentary disposition as well as donation notices or donation agreements.

In the case of gold, you have to provide proof of origin beginning at €2,500

If a bank customer wants to pay in foreign means of payment or precious metals at his bank that is not his house bank, he must already indicate the origin if the value of the deposited funds exceeds €2,500. For example, anyone who no longer has proof of their two Krugerrand gold ounces because they were bought many years ago and the receipt has been thrown away or faded will be rejected by the bank. In addition, the banks have an obligation to report in accordance with Section 43 of the Money Laundering Act.

The banks had long fought against the new rules. The German Savings Banks and Giro Association as well as the Federal Association of German People’s and Raiffeisen Banks had declared that the BaFin stigmatize cash without creating any added value in the fight against money laundering and terrorist financing. The required documents can hardly be checked for authenticity by a bank employee. In addition, it will be impossible for many customers to provide evidence. The banks are also often contractually obliged to accept cash as a deposit.

The Sparkasse Osnabrück, for example, writes on its website: “Purchases of precious metals and sorts (purchase of foreign means of payment, editor’s note) are handled by our contractual partner BayernLB. A corresponding proof of origin is required for an amount of €2,500 or more if the customer cannot provide proof of origin in such an occasional transaction, the institute must refuse the transaction.”

What can the gold seller do?

If you want to sell a few gold coins and no longer have a certificate of origin, there are still easy ways for you to do so. Because precious metals traders are not subject to the new BaFin rule on proof of origin. You can still sell your older coins and bars to a precious metals dealer, as Benjamin Summa, company spokesman for the precious metals dealer pro aurum confirms when it comes to retirement provision. Proof of origin can only be required in suspicious cases.

But even with precious metal dealers today it is very difficult to launder money and finance terrorism. Because when selling precious metals, the seller always has to prove his identity to the dealer. Even with the smallest amounts of old gold, small coins or bars, the seller has to identify himself. And when buying gold and silver, the customer has to prove his identity, but only from a value of €2,000. This regulation has been in place since the beginning of 2020.

Lets be frank.

Who the frag is laundering less than 10000 euros?

Who the frag is laundering less than 2500 euros of gold?

Money laundering is done through the government to those who own the government. That laundering is done in the millions of euros.

Who the hell would care about a measly 3k dollars in terms of gold, or 15k in terms of cash?

The cabal want a cut of EVERY transaction. That is the real deal.

I look forward to the return of the blackmarket for everything.

It wont be long before, if it isn’t already that the negatives of the internet outweigh the positives. I don’t use a mobile phone. I expect to cut the internet next year.

I strongly dislike anyone tracking me when I am not allowed to track them.

Restaurants, pubs, football games, and other so-called services have all been destroyed anyway and the missus is an absolutely awesome cook.

I will continue to collect gold and silver directly from those who mine it There will be plenty to be made from the off market price and the accepted price by the cabal’s assets. Proxies are a dime a dozen.

Head to Switzerland and deal with the smaller banks who do not co operate with the EU banking regs, just a little hint for those who see the writing on the wall.

I’d like to see the authorities in India try this!

Oh, and Hello Dali (sorry!)

It’s almost as if the western banking system did everything to promote the “shadow economy” and “black market”?

Gold is valuable even when the government says it isn’t, so these kind of measures will hardly stop any deals under the table.

During my work in various kind of immigrant neigborhoods in Sweden, I noticed how the muslim immigrants are completely out of the western banking system, and transfer money internationally through various “private enterprises”.

If the western banking collapses, guess who will have the gold standard oiled up and running? The muslims, of course.