I started building the graphic for this post in the summer of 2013, but abandoned it because working on it was too hard on my eyes. I came across the work-in-progress yesterday when I was doing housecleaning on this computer, and decided to finish it, since my eyes are much better now.

I had also saved a page with all my calculations involving the national debt, which at that time was estimated at $16 trillion. It’s roughly $18 trillion now — a 12.5% increase in just two years. In the same period of time, the price of gold has dropped by $100 an ounce. It was about $1,300/oz when I did the earlier calculations, and it’s hovering right around $1,200/oz this evening. Which seems counterintuitive to me, but then so does a lot of the other economic news these days.

I’ve redone all the calculations, finished the graphic, and am rushing everything into print before the debt clock and the gold markets make it obsolete again.

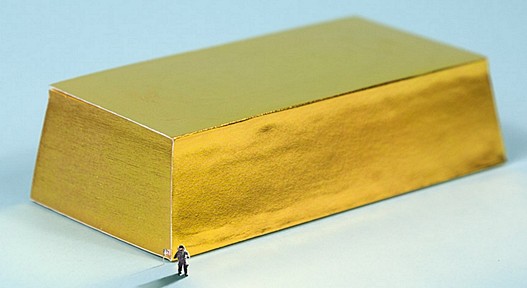

Let’s suppose the United States had to pay off its accumulated debt in gold. How much gold would that be, based on today’s market prices?

A standard gold bar that weighs a kilogram measures 80mm × 40mm × 18mm, or 3.15″ × 1.58″ × 0.71″.

The spot price of gold is about $1,200 per ounce, which is $19,200 per pound, or $38,400,000 per ton.

A ton is approximately 907 kilos, so there would be 907 one-kilogram bars in a stack of gold weighing a ton.

The national debt is over $18,000,000,000,000 and climbing rapidly, but I’ll peg it at $18 trillion, just to make the calculations easier.

When I looked into how much gold would be needed to add up to $18 trillion, the scale of the resulting graphic would have been too exaggerated to make visual sense — the astronaut standing next to the gold bar would have been too tiny to be recognizable in a normal-sized image. The calculations below are based on paying off one quarter of the national debt, or $4,500,000,000,000 ($4.5 trillion).

To determine the number of tons of gold needed for the payoff, we divide $4,500,000,000,000 by $38,400,000 per ton, arriving at an approximate figure of 117,188 tons. At 907 kilos per ton, 106,310,712 one-kilo gold bars are required.

The bars in the resulting pile would be stacked 474 long, 474 wide, and 474 high. Using the dimensions of each individual bar as given above, the rectangular solid formed by the whole pile would be 37.9m × 19m × 8.5m, or 124 feet long, 62 feet wide, and 28 feet high.

That’s as big as a McMansion, but remember: it represents only 25% of the national debt. Four of those piles taken together would be as big as the Ritz.

According to the BBC, the world’s entire supply of gold is estimated at 171,300 tonnes, or “long tons”. Multiplying that number by 1.1023 gives us 188,826 “short tons”. The 117,188 tons necessary to pay off one quarter of the debt would thus consume five-eighths of all the gold in the world. To pay off the entire national debt would require 2.5 times the world’s gold supply.

If it wasn’t obvious before, it should be clear by now that the U.S. national debt will never be paid off. There is no indication that the debt will ever be reduced; in fact, its growth is accelerating. Productivity is not rising at a level that would increase national wealth enough to provide the requisite tax revenues. Congress and the Executive are not reducing spending. And the Baby Boomers are retiring now by the millions, which will draw down Social Security and Medicare, forcing the debt to rise even faster.

Every national political official, elected or appointed, knows all this. If he has an IQ above room temperature, he knows that in the long run, there are only two choices open to the federal government: (1) Default on the debt, or (2) monetize it. Or some combination of both.

Monetizing the debt — what is commonly known as “printing money” — is the most likely outcome; it avoids reneging on international agreements. The process has already begun with the repeated regimes of “quantitative easing”, but those have not worked their way through to massive price inflation yet.

One reason is that the prices of gold and silver have not risen to levels that would normally be expected, given the increase in the paper (or really, digital) money supply. Everyone I’ve talked to who has any expertise on the topic says that the only way this can be explained is by price manipulation in the precious metals markets. For example: it is thought that federal regulators have allowed (if not encouraged) the issuance of paper silver futures far in excess of all the silver in the world, even including known reserves that have not yet been mined.

High-flying traders can keep passing these IOUs around all they want. Everyone pretends that they have real value, but they don’t. At some point the holders of all these pieces of paper will try to redeem them, and that’s when the fun begins.

I’ve learned not to predict when the day of reckoning will arrive — it has been postponed five or six years longer than I ever thought it could be — but arrive it will. Maybe not this decade, maybe not in my lifetime. But it has to happen; it’s mathematically inevitable.

The fiat money system must someday collapse, and the Palace of Paper — which is far larger than the Ritz — will come fluttering down.

Sorry Baron, but for gold there are 12 ozs in a pound; they use Troy weight.

Well! That messes me up, doesn’t it? Thank goodness it doesn’t throw me off by an order of magnitude — the astronaut can be a midget or a giant, but the analogy remains valid.

No way am I redoing that graphic, though. A back-of-the-envelope calculation says the price of a “real” ounce would then be $900, which means the debt would take up a third again as much gold as previously described. So the astronaut in the picture must be Andre the Giant! And the McMansion of gold takes up about 5/6 of the world’s gold.

Interesting.

We’ve been on that roller coaster ride for some time now, in fact ever since the Gold standard was rejected the roller coaster has been gaining and gaining in speed and with every twist and turn brings with that ride so many uncertainties that it is almost impossible to predict when the ride will end and we can all get off – those that survive the ride that is.

BTW, that gold bar even though it only represents one quarter of the debt is about the same size as those massive stone blocks that were carved out of the mountainside at Baalbek in Lebanon all that millennia ago. Unlike our greedy Banks and Corporations today, at least those who managed to carve such massive monoliths, and so long ago, knew of their limitations.

I appreciate both the visual and narrative demonstration of this disaster for an economic dunce such as myself. This taken in light of the spin and deception imposed on the country by all politicians and bureaucrats daily as well as the TV and radio talking heads daily leaves one speechless. Thank you.

the spot price of gold & other precious metals is always quoted in Troy ounces, of which there are 14 per pound ; it’s NOT the usual 16 ounces per pound you used in your calculations

therefore, at $1,200/oz price, a pound = $16,800 , not the $19,200 you used

the difference is substantial , about 15%

I’m a fan of yours & multiyear donor/supporter (recognize my email address) ;

but the engineer in me doesn’t want to see the error go uncorrected

thanks for your good work ; I read your blog every day

Well, this is interesting — I just answered someone else who said there were 12 Troy ounces per pound!

Another quick back-of-the-envelope calculation: that’s $1050 per “real” ounce. So Andre the Giant has shrunk a little. Maybe the astronaut is actually Lurch…

You,,, Rang? Eh, just a moment in time needed to meet and beat this golden firmament. Gubmint uses strange measurements. I for 1 prefer the more accurate variations of:

cheese

wheat

schugg rr

apples/oranges

onions

potatoes (sic)

coffee… .maybe the best tiny indicator?

BTW…money is pouring into the stock market =up. Parable:

A man has two choices, making money or no money in bank.

Supermarket prices have gone up, but not nearly as much as they should have. If there really is 10 to 20 times as much silver paper in circulation as there is physical silver, the price of coffee should have risen by an order of magnitude, but it hasn’t.

Conclusion: prices are being manipulated to keep them artificially low. Until the system breaks, that is — then they will adjust themselves like a broken cable snapping back. Don’t be standing next to the donkey engine when that happens!

Now consider: At an average wage hour, how many hours of labor will be required by say 350,000,000 so-called Americans (because there is a bunch of us who are not) to buy this big gold brick? Oh, that’s right, we already bought it; we just haven’t paid for it.

Good that you are reviving this topic. People may have forgotten when they are reading constantly about how this is the best year ever for MBZ, for Rolls-Royce etc, how the American economy is reviving, how many new, young megamillionaires were minted in 2014 –all in what’s called in Yiddish (and in industries with a partial Yiddish lexicon, e.g. “Hollywood”) Luft Gescheften (“air businesses’) that just shuffle some ones and zeros on flimsy websites to stroke the vanity of their “social media” customers.

In this too, I am amazed by the pig-headed stupidity, the myopia, the total moral-spiritual-intellectual corruption of our “best and brightest.” One of those, John Connally, when he was Nixon’s Secretary of Treasury, responded to Europeans that were worried about the decoupling of the dollar from its gold basis: “The dollar is our currency, but it’s your problem.”

Not for much longer.

Not too long ago Germany, quite reasonably, asked for it’s gold back. The US answer was “Well, you’re gonna have to wait for a while.”

There’s gold in Fort Knox but curiously no one gets to do an audit of what’s actually there. Move along, nothing to see here. Surely the government wouldn’t lie to us.

As you note there is no way the US debt is ever going to be paid back. They’re just keeping the balls up in the air as long as they can so that they can line their pockets. The rest of us poor plebs will have to deal with the fallout.

Hmm… Germany has never repaid all of its WW1 reparations, and stole the Greek gold reserves in WW2 (bet the Greeks would like then back now!)

I think the US should stick its debt on Amex- problem solved!

Dishonor among thieves? Say it isn’t so.

USA steals from Germany, Germany steals from Greece. And they all steal from you and me.

Yes indeed. A whole globe of kleptocrats.

Germany never repaid all of its (admittedly unjust) WW1 reparations; it also stole the Greek gold reserves in WW2- daresay the Greeks could use them now!

I think the US should stick its debt on Amex; problem solved!

The national debt isn’t ever going to be paid off, but then again it needn’t be that the US goes into default any time soon. The middle road would be that the debt continues to grow, but not in proportion to the national economy. There are any number of impressive new technological possibilities. The economy has the potential to grow.

I like reading your Counter-Jihad stuff, and occasionally I read some of your ‘off topic’ stuff (like this), but I have to call “shenanigans” on this one. I don’t like Obama for a whole lot of reasons, but it’s curious how conservatives always complain about the debt, BUT ONLY WHEN A DEMOCRAT IS PRESIDENT.

http://zfacts.com/p/318.html

If you read it closely, it states that Bush 43 did EXACTLY what Reagan and Bush 41 did, running up huge deficits and, then the recession hit causing those deficits (and the debt) to soar even more. Obama inherited those deficits (and the recession) and was the first Democratic president, since WWII, to be as irresponsible as a Republican.

Welcome to the era of permanent fiscal irresponsibility.

Just don’t act like Obama isn’t doing EXACTLY what Republicans did for over a quarter century before he took office.

Mr. Porkistan:

I have been complaining about the national debt for many years, including those of the most recent Bush administration. You have evidently neglected to read the archives, and you made some assumptions. You know what happens to people who assume, don’t you?

You just bruised yourself jumping to conclusions.

One may infer from your words that I consider myself a Republican. Fat chance! I hate Republicans. The only thing worse than a Republican is a Democrat.

Sorry. It’s just that I’ve been seeing these diatribes about the debt starting with Ross Perot in 1992. During the Clinton years, every other month, Fox news had stories about the debt even as the debt to GDP ratio was going DOWN (at least until Monica Lewinsky). Then, during the Bush years as the debt skyrocketed out of control Fox News (and most EVERY other conservative rag and blog) said NOTHING. TWO unpaid for wars, TWO huge tax cuts, and a huge Medicare Part D big business giveaway and NOT ONE PEEP.

Now that we have a Democratic president again, the debt is all important again.

I’ve just become so sick of the rampant hypocrisy of the Conservatophere with regards to this particular subject. It seems (other) Conservatives only care about the debt when it’s being used for Social Security, or food stamps, or education, or anything Democrats like. But if the spending is for wars, or the military industrial complex, or tax cuts for the rich, or huge giveaways to the health insurance industry, it’s a never ending party with “daddy’s no limit credit card”

On this one subject, conservatives (or at least Republicans) rival muslims in hypocrisy.

It’s been over 23 years since Ross Perot said: “Debt is like a crazy aunt we keep down in the basement. All the neighbors know she’s there, but nobody wants to talk about her.” And it’s been 34 years since Reagan’s first unbalanced budget.

Maybe a less famous Ross Perot quote would be more apropos. When Bush accused him of not having any government experience Perot replied: “I don’t have ANY experience in running up a $4 trillion debt.”

I voted for Ross Perot. Twice.

I’m sorry if I come off as cranky but massive deficits (and massive illegal immigration) both STARTED during in my lifetime and I’m morbidly sure that they both will NOT be solved before I die.

Porkistan–

Good for you for voting for Perot for economic reasons. But the effect of Perot’s run was to give the presidency to Bill Clinton. Twice. On the second round, the GOP ran the guy who said it was “his turn”. Considering what went down in Clinton’s second term, perhaps Dole would’ve saved a lot of polarization and we wouldn’t have had Benghazi since ol’ Hillary certainly wouldn’t have been the Sec State during Obama’s reign.

Clinton was an empty suit – all penis, no persistent policy. It’s not that he had no accomplishments, but they weren’t enough to overcome the soul rot those two represented. We’ll be another generation figuring out the depth of their criminality. And by then we may have finally sundered the Union. It does appear to be the rebirth of the city state.

I still won’t go for a spoiler vote given how our set-up works. I may not bother voting since the GOP is a useless mini-me, even when they have a majority. The only reason I’d EVER go 3rd party is if there were a competent Tea Party candidate – then we’d see some genuine grass-roots action.

The global demographic implosion (Muslims, too – no one is exempt) at the half-century mark makes all our suppositions so much airy-fairy idle talk anyway. Where we learn once again that the only thing that never changes is Change.